And sufficiently high turnover is in most cases not generated right after the company is founded.

But this is only achieved when revenue is higher than costs.

BREAK EVEN POINT FORMULA PROFESSIONAL

When stock options trading becomes involved, things become a little more complicated and the breakeven analysis becomes more complex.Every business professional would like to eventually generate profit.

If the stock price stays at $100, you are at the breakeven point and have not lost or gained any more money. If the selling price falls to $75, you will lose money versus if the stock sale price rises above $100 to $125, you will make a profit of $25 per share. You can use the breakeven point analysis to figure out when you’ll make back the money you used to buy stocks.įor example, as an investor, you buy a stock share for $100. The stock market isn’t as intimidating as it sounds.

BREAK EVEN POINT FORMULA HOW TO

How To Calculate Your Breakeven Point In The Stock Market That means in 20 months, you will recoup the cost of refinancing your mortgage and you will break even. When you break even on a mortgage, you begin to save money and recoup finance costs.īreakeven Point = Total Fixed Costs ÷ Monthly Savings (aka Contribution Margin)įixed costs = $2,000 (refinancing fees and closing costs) Then to determine how many months it will take to break even on your mortgage, divide the total loan costs by your monthly savings. To determine your total refinancing costs, total up your closing costs and fees. You can determine the value of a refinance on your mortgage loan by calculating the refinance breakeven point. How To Calculate Your Breakeven Point On A MortgageĪs a homeowner, you may come to a point where you’re looking to have extra cash and may seek to refinance your mortgage loan. Cheers to a hot summer and drinking lots of lemonade. To break even in dollars, you would need to sell $240 worth of lemonade.

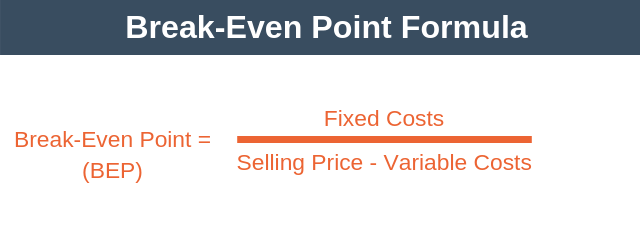

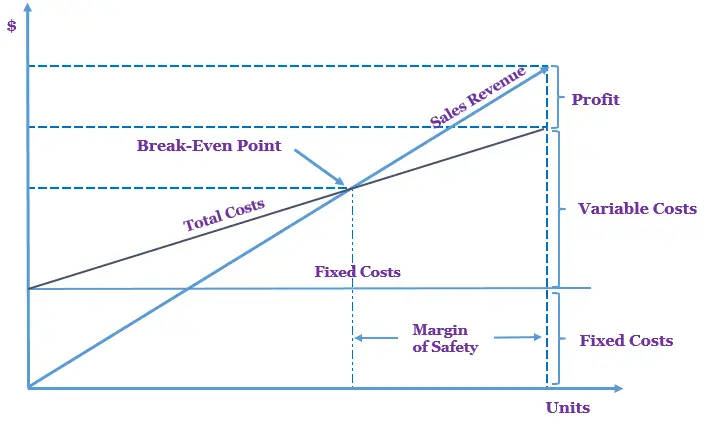

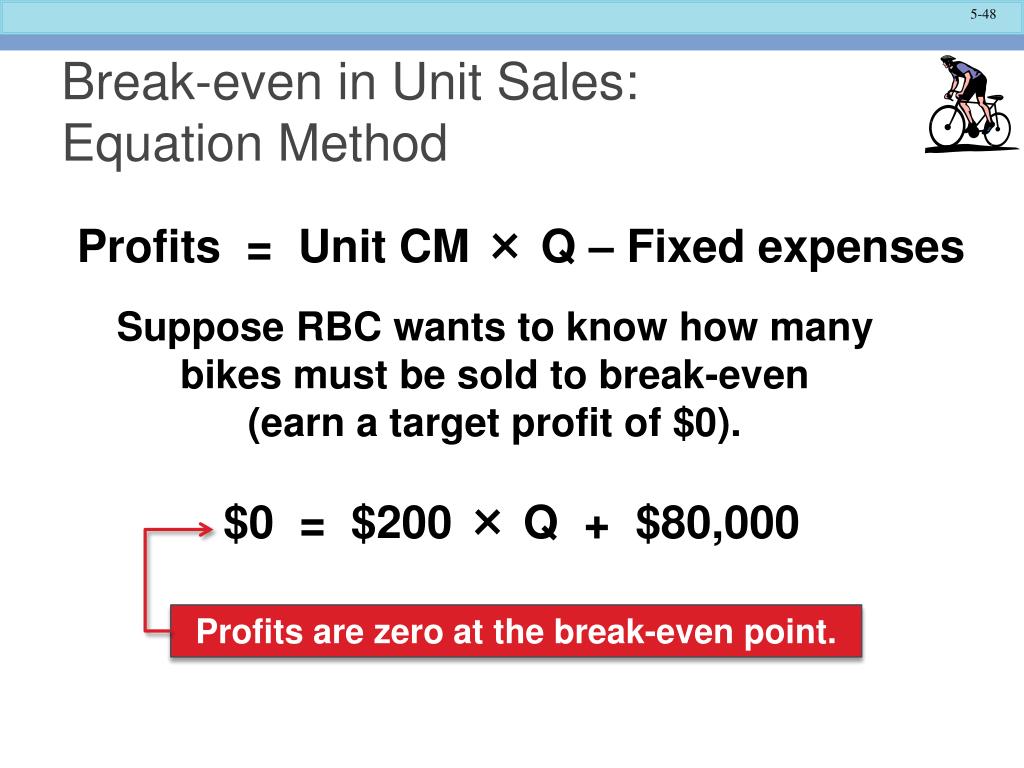

To calculate the breakeven point in dollars:īreakeven Point (In Dollars) = Fixed Costs ÷ Contribution Margin In this case, you would need to sell 160 cups of lemonade in 1 month to reach the breakeven point. Your accounting costs are as follows:įixed costs = $200 (total for monthly supplies like water, sugar, lemons, cups, etc.) It’s beneficial to perform a breakeven analysis and examine the margin of safety for your business, to limit future financial restraints and set realistic sales volume goals.īreakeven Point (In Units) = Total Fixed Costs ÷ Contribution Marginįor example, you have a lemonade stand and want to know how much lemonade you need to sell to break even. When a business has reached its breakeven point, this means the company is operating at neither a net loss nor a net gain. When you start a business, creating a business plan is one of your first moves. How To Calculate Your Breakeven Point In Business Let’s take a look at how to use a breakeven point formula in different situations. The contribution margin ratio is the difference between the sale price minus the variable cost and then divided by the sale price per unit. The sales price per unit is how much consumers are charged for the product. Variable costs are often associated with labor or material costs used in production. Fixed costs are costs that are not affected by the level of sales volume and will remain the same. Let’s break those formulas down even further. The only difference between the two formulas above is how the contribution margin is reflected in the formula.

0 kommentar(er)

0 kommentar(er)