Bob purchases supply to use around the store costing $3000. Bob purchases $20,000 of inventory on credit from the vendors and agrees to pay $1000 per month. He agrees to pay $1000 per month for three years to repay the loan.

Bob borrows $25,000 from the bank to pay for renovation and improvement expenses on the property. Bob finds a good rental place on one of the busiest streets in his location and signs a lease for $750 per month. Bob forms the Donut Shoppe, Inc by purchasing 50,000 shares at $1 per share.

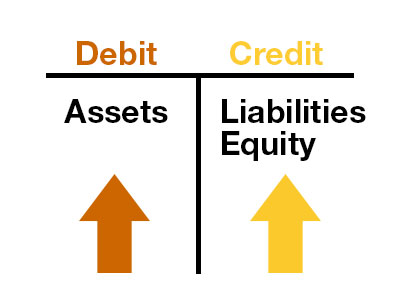

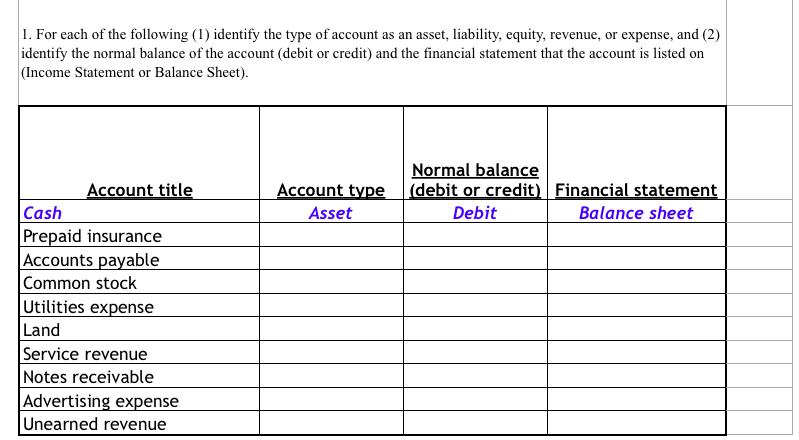

The following business transactions take place in the first year of business: Transactions Throughout this account cycle series, we will follow Bob and his company, Bob’s Donut Shoppe, Inc. The new accounting equation is shown below: Both entries will affect the accounting equation as the purchase of inventory would increase the assets side and the credit facility used would increase the liability side.Īfter this journal entry, the assets and liabilities increase: These business transactions would then be journalized in the general journal using the debit and credit rules in the following manner: Journal Entry 1Īs per the rules of the debit and credit system, any increase in assets (inventory) is recorded as a debit entry and an increase in liabilities (accounts payable) is recorded as a credit entry.

Each business transaction journalized via a double-entry system will affect the accounting equation. The accounting equation is the bedrock of the double-entry bookkeeping system. To identify whether a transaction has an economic impact, it should be analyzed through the accounting equation.

Debit credit asset liability download#

We also have an accompanying spreadsheet that shows you an example of each step.Ĭlick here to download the Accounting Cycle template Understanding the Accounting Equation

Below is the complete list of accounting cycle tutorials:

Debit credit asset liability series#

Throughout this series on the accounting cycle, we will look at an example business, Bob’s Donut Shoppe, Inc to help understand the concepts of each part of the accounting cycle. A General journal is a daybook or a master journal in which all company transactions that occur during an accounting cycle are recorded. This step starts at the beginning of the accounting cycle and lasts throughout the period.Īfter identifying which transactions have an economic effect, the bookkeeper will journalize these entries in the general journal. The process involves analyzing business transactions to determine whether a certain transaction has an economic impact on the company’s books. Journal entries are usually the first step of an accounting cycle.

0 kommentar(er)

0 kommentar(er)